A white paper released by Bloomberg New Energy Finance (BNEF, New York, NY) compares the cost of solar photovoltaic (PV) generation and conventional generation and finds PV already competitive with daytime retail power prices in several nations.

The paper examines the 75% decline in panel prices since late 2008 against other generation technologies plus electricity rae hikes. PV power is actually cheaper than standard residential electricity rates in Australia, Denmark, Germany, Hawaii, Italy and Spain. Based on PV cost predictions, cheaper solar-powered electricity will also be the case for Brazil, California, France, Japan and Turkey as soon as 2015.

Solar Industry follows the pattern

The solar industry is experiencing what the auto and computer industries in their early emergence. In the U.S. during the early 1900's there were as many as 200 car makers. Standard attrition (failures), consolidation and automation trimmed car makers down to about 20. Today there are only--and barely--the Big Three auto makers left.

The emerging solar industry is somewhat different, however. While there are many more makers of high-grade silicon cells than just six years ago, companies that make only panels are finding it hard or impossible to stay in business on ever-decreasing margins. Diversified PV makers, those whose core revenue is generated by other products, have a better chance of hanging tough. Sunpower and Schuco are examples of this. Still, Schott Solar, whose parent company in Germany is huge in glass products, decided to bow out of PV earlier this summer. The 400MW plant in Albuquerque is scheduled to close by Nov. 1. One might surmise Schott simply decided not to drain its money-maker on its weakening solar sister.

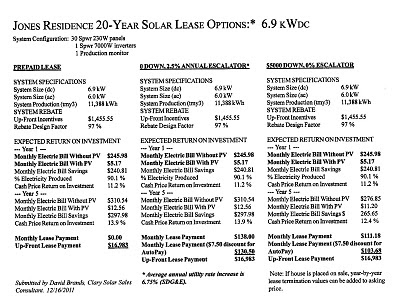

As with all fierce competition, the consumer really wins. Residential solar systems in the San Diego market are selling for as much as half the cost of what the same size installations cost in 2006. Standard loans, same-as-cash loans and no-money-down leases also make going solar attractive to those hard hit by the housing crisis of 2008-09.

Not only cheaper but better

PV panels are now at historically low pricing but that has not been reflected in lower quality. As crystalline cell manufacturing gets better, the market is seeing higher wattage panels in the same unit sizes as before (module efficiency). What's more, most panels now have 10- and some even 12-year warranties on materials and workmanship besides the 25-year production warranties at 80% of original output. Inverters, too, are improving while dropping in price. Earlier last decade inverter efficiencies ranged in the 91.5 to 95% range; many of today's are running at 96%-plus. Similarly, inverter warranties were at five years but now run 10 years. Enphase micro-inverters are even warranted for 25 years.

Rebates are less important

The wildly successful California Solar Initiative is in its last steps of funding. Step 10 which pays .20/Wac has become much less a factor in PV installations as equipment costs of fallen so drastically.

Not wanting to sound trite but in a nutshell: It's never been a better time to go solar!